Step-by-step explanation

Tariff, also known as customs duty, is a tax imposed on goods as they cross national borders. A purely protective duty tends to shift production away from export industries and toward protected domestic industries or other industries producing substitutes for which demand grows. Tariffs are frequently imposed or removed to achieve political goals. Tariffs are further subdivided into three categories: transit duties, export duties, and import duties. Tariff, duty, and customs are all terms that can be used interchangeably to refer to the tax on imported goods. Tariffs can also refer to a tax on domestic production (in order to avoid protecting it) or an equivalent tax on foreign production (to avoid producing it). Tariff can also refer to a tariff intended to raise revenue or protect domestic industries, but not to a duty intended to raise revenue. The term "tariff" also refers to the customs duty levied on imported consumer goods.

References:

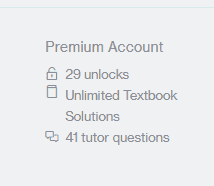

You do not have permission to view the full content of this post.

Log in or register now.