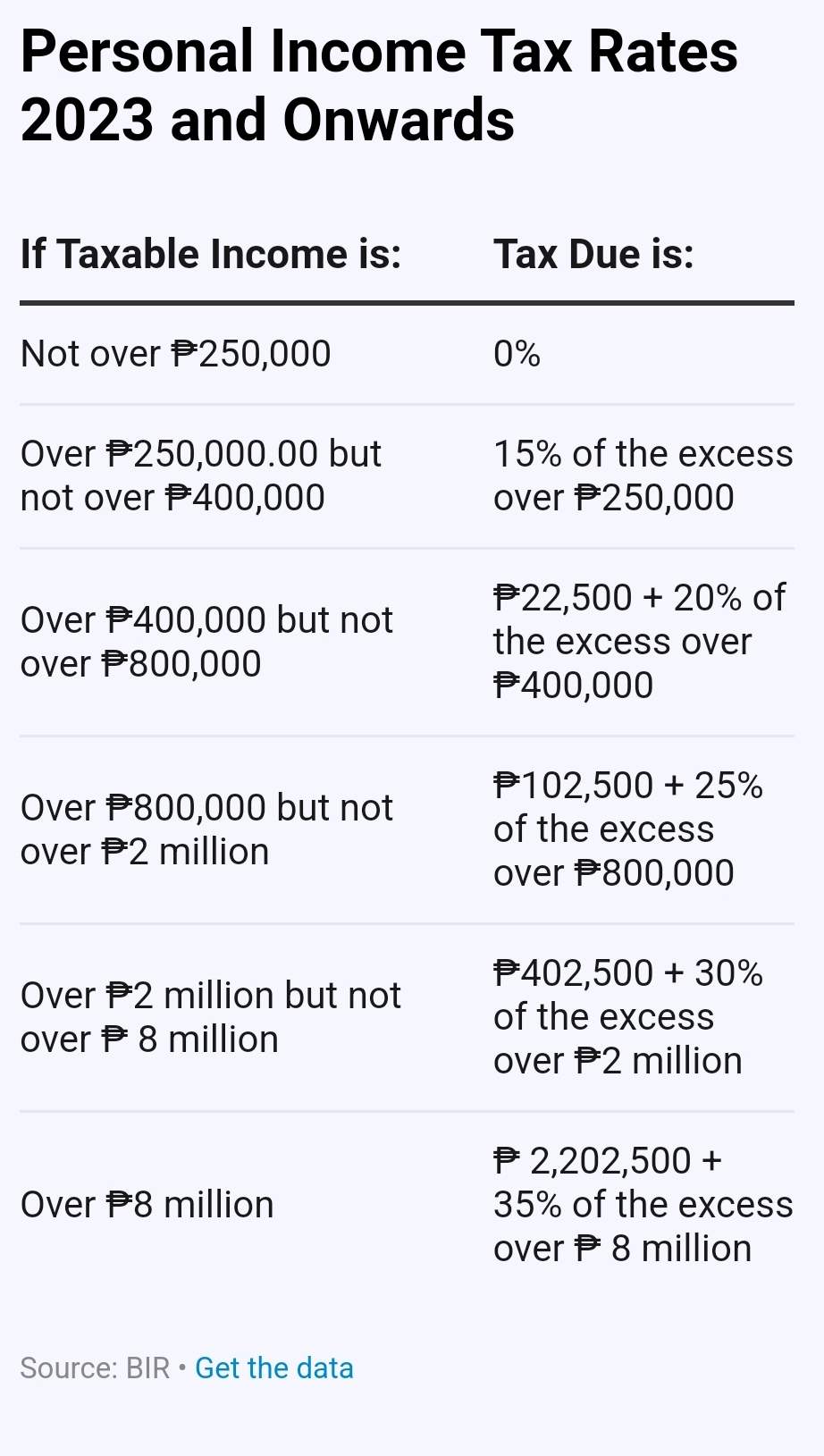

MANILA, Philippines – Filipino workers are getting higher take-home pays in 2023 as the TRAIN Law further reduces personal income taxes.

Under the TRAIN or the Tax Reform for Acceleration and Inclusion Law, individuals earning purely from compensation income whose taxable earnings are less than P8 million yearly will have lower tax rates ranging from 15% to 30% starting January 1, 2023.

Source: You do not have permission to view the full content of this post. Log in or register now.

Under the TRAIN or the Tax Reform for Acceleration and Inclusion Law, individuals earning purely from compensation income whose taxable earnings are less than P8 million yearly will have lower tax rates ranging from 15% to 30% starting January 1, 2023.

Source: You do not have permission to view the full content of this post. Log in or register now.

Attachments

-

You do not have permission to view the full content of this post. Log in or register now.