Quantum Supercomputer

Eternal Poster

- Joined

- Dec 23, 2017

- Posts

- 740

- Reaction

- 250

- Points

- 339

- Age

- 23

Pag nabasa mo 'to never ka ng gagamit ng:

Ano malalaman mo dito?

PART 1

Unang bungad mo sa crypto ito yung mga advices na makukuha mo sa mga mapagpanggap, "Wag ka gagamit ng mataas na leverage", "Bakit ka nasa small time frame, higher timeframe dapat lods", "Spot trading ka muna para safe", "sali nalang tayo ng airdrop, andami na pumaldo", "Follow mo yung group namin, sali ka samin", "bakit ka naginvest dyan, nafomo ka"

Anong mali dito, tama naman sila? These are all "collective beliefs", good as superstition.

Ok, Let's start on "Leverage",

kung nasa futures ka or derivatives, mapapansin mo yung "qty or size", at ito lang dapat pagtutuunan mo ng pansin, other option such as

- margin, leverage, na madalas pinapakita ng "crowd" sa social media, 10seconds is good enough, tapos wag mo ng pansinin

If you want to invest X USDT,

use this formula :

Let -

size as S

potential risk as R

stop loss as SL

s = r/sl

let's say you want to risk 10USDT on one trade, and you found the technical level below the support as 1%

you need to divide the risk vs stop loss %

10/1%

= 1000USDT

the result is your size

san ako kukuha ng 1000USDT? that's where the leverage comes in

No matter what the leverage, you still risking 10usdt in accordance to your stop loss, kahit 50X pa yan or 100X, you still risking the same

PART 2

Smaller timeframe vs Higher Timeframe

All timeframe are traded the same,

Trend and Trading Range

Also known as Uptrend, Downtrend, Sideways

PART 3

Airdrops

out of 500 Airdrops, ilan ang legit dun?

1? 3?

Let's say you've join 200 of them, what are the chances of you making money out of them?

Now, let's compare it to the breakout traders,

sa 500 na cryptocurrency, ilan ang ang magpapump dun at certain time?

XRP breaks out, ADA breaks out, PEPE breaks out, how about yung ibang coin?

Let's say you invest only 5 of them out of 500, how likely are you going to win in that trade?

As you can see both of them has low winning rate, so why bother?

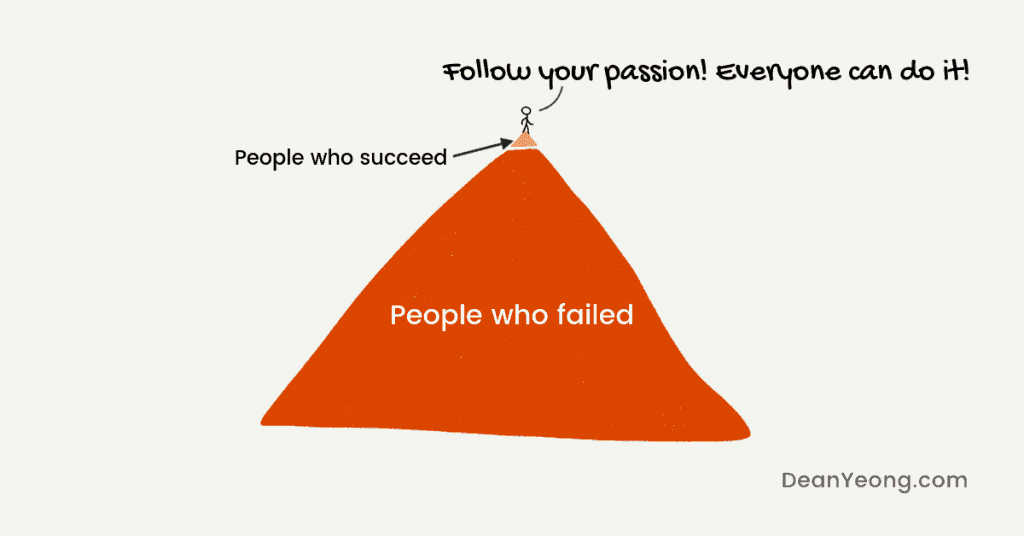

Sa social media natin makikita yung mga nanalo, pero ilan sila? This is also known as Survivorship Bias

Solution :

Find what is More Likely to Happen

This connects us to -

Part 4

Good Risk and Reward is a joke

"1000php lang ininvest ko dito 1M na ngayon"

"5:1 ratio ko every trade 88% winrate"

"7:1 90% winrate"

Ganyan yung mga linyahan ng mga nagbebenta ng courses,

liitan mo yung risk mo then lakihan mo yung reward

the problem is How likely is going to be hit?

Let's say nagset ka ng trade at anlayo ng target TP mo, at mababa ang risk mo, now ang tanong ano ang mas madaling mahit sa dalawa?

Malamang yung stop loss mo, that's why higher reward is rare, hence lower probability, so why bother?

The thing is kapag nilakihan mo yung risk mo at nilapitan mo yung TP mo, mas mataas ang winrate, because this is more "Likely to happen"

How insurance makes money? dahil rare ang accident, minsanan lang sila natatamaan ng risk, pero It is more common na may member na sasali

This leads us to -

Part 5

Law of large numbers

To be written soon

- Spot trading

- Higher Timeframe

- Good Risk and Reward

- Sasali sa airdrop

- Magbabasa ng post sa mga groups

- Gagamit ng pop psychology such as "FOMO"

Ano malalaman mo dito?

- Probability

- Statistics

- Heuristics and Biases

PART 1

Unang bungad mo sa crypto ito yung mga advices na makukuha mo sa mga mapagpanggap, "Wag ka gagamit ng mataas na leverage", "Bakit ka nasa small time frame, higher timeframe dapat lods", "Spot trading ka muna para safe", "sali nalang tayo ng airdrop, andami na pumaldo", "Follow mo yung group namin, sali ka samin", "bakit ka naginvest dyan, nafomo ka"

Anong mali dito, tama naman sila? These are all "collective beliefs", good as superstition.

Ok, Let's start on "Leverage",

kung nasa futures ka or derivatives, mapapansin mo yung "qty or size", at ito lang dapat pagtutuunan mo ng pansin, other option such as

- margin, leverage, na madalas pinapakita ng "crowd" sa social media, 10seconds is good enough, tapos wag mo ng pansinin

If you want to invest X USDT,

use this formula :

Let -

size as S

potential risk as R

stop loss as SL

s = r/sl

let's say you want to risk 10USDT on one trade, and you found the technical level below the support as 1%

you need to divide the risk vs stop loss %

10/1%

= 1000USDT

the result is your size

san ako kukuha ng 1000USDT? that's where the leverage comes in

No matter what the leverage, you still risking 10usdt in accordance to your stop loss, kahit 50X pa yan or 100X, you still risking the same

PART 2

Smaller timeframe vs Higher Timeframe

All timeframe are traded the same,

Trend and Trading Range

Also known as Uptrend, Downtrend, Sideways

PART 3

Airdrops

out of 500 Airdrops, ilan ang legit dun?

1? 3?

Let's say you've join 200 of them, what are the chances of you making money out of them?

Now, let's compare it to the breakout traders,

sa 500 na cryptocurrency, ilan ang ang magpapump dun at certain time?

XRP breaks out, ADA breaks out, PEPE breaks out, how about yung ibang coin?

Let's say you invest only 5 of them out of 500, how likely are you going to win in that trade?

As you can see both of them has low winning rate, so why bother?

Sa social media natin makikita yung mga nanalo, pero ilan sila? This is also known as Survivorship Bias

Solution :

Find what is More Likely to Happen

This connects us to -

Part 4

Good Risk and Reward is a joke

"1000php lang ininvest ko dito 1M na ngayon"

"5:1 ratio ko every trade 88% winrate"

"7:1 90% winrate"

Ganyan yung mga linyahan ng mga nagbebenta ng courses,

liitan mo yung risk mo then lakihan mo yung reward

the problem is How likely is going to be hit?

Let's say nagset ka ng trade at anlayo ng target TP mo, at mababa ang risk mo, now ang tanong ano ang mas madaling mahit sa dalawa?

Malamang yung stop loss mo, that's why higher reward is rare, hence lower probability, so why bother?

The thing is kapag nilakihan mo yung risk mo at nilapitan mo yung TP mo, mas mataas ang winrate, because this is more "Likely to happen"

How insurance makes money? dahil rare ang accident, minsanan lang sila natatamaan ng risk, pero It is more common na may member na sasali

This leads us to -

Part 5

Law of large numbers

To be written soon

Attachments

-

You do not have permission to view the full content of this post. Log in or register now.